The president’s sweeping tariff plan has thrown markets into chaos and risks sparking a global trade war.

Source link

Trump says tariff policies ‘WILL NEVER CHANGE’ amid plunging stocks, Chinese response

As Tariffs Hit, Americans Are Racing to Buy Car Seats, iPhones and Christmas Gifts

Emily Moen, a coffee shop manager in Omaha, was scrolling through TikTok earlier this week when she came across a video informing her that President Trump’s tariffs could lead to higher prices for essential baby products.

Ms. Moen, who is 15 weeks pregnant, said that she had not planned to buy a car seat soon. But after watching the video, she researched the one made by Graco that she had been eyeing, and learned that it was manufactured in China. Worried that the $200 seat could get even more expensive, she bought the item on Amazon the same day.

“It was like an awakening to get this done now,” said Ms. Moen, 29.

As the Trump administration’s trade war with China escalates, many consumers have raced to purchase foreign-made products out of fear that companies could start to raise prices soon. Some have rushed to buy big-ticket items like iPhones and refrigerators. Others have hurriedly placed orders for cheap goods from Chinese e-commerce platforms.

The White House this week imposed a minimum tariff rate of 145 percent on all Chinese imports to the United States, on top of other previously announced levies, including a 25 percent tariff on steel, aluminum, cars and car parts.

And last week, Mr. Trump ordered the end of a loophole that had allowed goods from China worth less than $800 to enter the United States without tariffs.

Some early data show that consumers flocked to stores and stocked up on goods after the administration announced sweeping tariffs on nearly all trading partners. Mr. Trump backed down on some of those threats this week and instituted a 90-day pause on more punishing levies. But he said that the halt would not apply to China, and he instead raised tariffs again on all Chinese goods.

China is the second largest source of U.S. imports, and makes the bulk of the world’s cellphones, computers and toys. Late Friday, the Trump administration issued a memo that appeared to exempt smartphones, computers and other electronics from most of its punishing tariffs on China.

According to Earnest Analytics, a firm that analyzes data on millions of debit and credit card payments, consumer spending at Apple was up 20 percent between April 2 and April 7 compared with average spending there in recent months. Spending was also up 10 percent at Home Depot and 18 percent at the department store chain Belk, according to the analysis.

Consumers have also raced to grocery stores, large discount chains and car dealerships in recent days. Purchases of shelf-stable goods surged in the five days following Mr. Trump’s tariff announcement on April 2, with sales of canned and jarred vegetables up 23 percent, sales of instant coffee up 20 percent and ketchup sales up 16 percent compared with the same period the week before, according to data from Consumer Edge, a company that tracks consumer behavior.

Although some consumers have been more strategic with their purchases, others might be stockpiling because of uncertainty about which products will be affected by tariffs, and whether companies will raise prices, analysts said.

The threat of higher prices has also prompted many consumers to buy electronics, particularly iPhones. For more than a decade, American shoppers have purchased iPhones each year beginning in September, when Apple releases its newest models. But Mr. Trump’s tariffs have turned April into this year’s iPhone-buying season.

Apple makes roughly 80 percent of its iPhones in China, according to Counterpoint Research, a technology research firm. The exemptions for reciprocal tariffs that the Trump administration issued on Friday for certain electronics did not appear to apply to an earlier round of levies it had imposed on China. The administration had applied a tariff of 20 percent on Chinese goods for its role in supplying fentanyl to the United States.

“There’s panic buying going on and panic selling by investors, too,” said Gene Munster, managing partner at Deepwater Asset Management. “It’s more turmoil than I’ve seen in 20 years following the company. The speed of it has been crazy.”

Tom Barnard, 49, a university marketing director in Waco, Texas, said that he helped his mother buy a new iPhone 16 on Friday. Mr. Barnard said that his mother would have waited for the newest model to come out, but that he thought that it was wiser to make the purchase now, in case Apple increased prices later this year.

“I think we’re going to be in a trade war with China until at least through the end of the year,” he said.

Mr. Barnard said that he and his wife also spent around $650 at Walmart last weekend, in large part because they were concerned that tariffs could raise grocery costs.

Some parents have even debated buying Christmas gifts eight months early, to stave off higher prices. In Facebook groups and on message boards dedicated to families, parents debated what to buy, given the attention span of toddlers. Parents asked each other if their children would still be interested in narwhal or unicorn toys at the end of the year, or if it was better to go for a more standard gift, such as Lego sets.

In one Facebook group for families in the Los Angeles area, parents shared notes about Apple products, video game consoles they had purchased and where they had seen the lowest prices.

“We were talking about getting our son an iPhone when he turns 14 at the end of the year, but we are going to buy it now,” wrote one parent, in a Facebook group for families in the San Francisco area. “We just have to hide it from him until his birthday.”

Other consumers have been preparing for the possibility of higher prices for months. Bree Chaudoin, 47, a lending support specialist in Normal, Ill., said she upgraded her iPhone shortly after Mr. Trump was elected in November, out of concern that prices could rise if he imposed new tariffs. Ms. Chaudoin said that she also started saving up for new camping gear late last year.

About a month ago, Ms. Chaudoin purchased a $1,500 rooftop tent for her car that appeared to have been manufactured in China. She also ordered a new water tank, camping lanterns and fire tongs from Temu and AliExpress, popular e-commerce platforms with Chinese owners.

Ms. Chaudoin said that she typically tries to buy as many American products as she can. But a similar water tank produced domestically, she added, would have cost at least $120 more.

“I have a very tight budget,” she said. “When they sell these products that are such high quality and for a less amount of money, it just didn’t make sense to me to buy them anywhere else.”

Even though the recent surge in sales has provided a boon for some companies, retail analysts said that firms appeared to be more concerned about consumers pulling back on spending. Wall Street economists have lowered their forecasts for growth and warned about a potential recession amid a global trade war. Consumer sentiment has also tumbled as households grow more anxious about inflation.

“When I talk to companies, they’re more worried that people are not going to buy,” said Simeon Siegel, a retail analyst at the investment bank BMO Capital Markets.

Tripp Mickle and Sheera Frenkel contributed reporting.

Trump Tariffs Add to Apple’s Long-Standing Innovation Woes

Even before President Trump’s tariffs threatened to upend Apple’s manufacturing business in China, the company’s struggle to make new products was leading some people inside its lavish Silicon Valley headquarters to wonder whether the company had somehow lost its magic.

The tariffs, which were introduced April 2, caused Apple to lose $773 billion in market capitalization in four days and briefly lose its standing as the most valuable publicly traded company in the world. But investors had already started to sour on the company, sending its share price down 8 percent in the first four months of the year, double the S&P 500’s decline.

Apple had hoped to revive its fortunes over the past year with a virtual reality headset, the Vision Pro, and an artificial intelligence system called Apple Intelligence. Sales of the headset have been a disappointment, however, and the signature features of the A.I. system have been postponed because it didn’t work as well as the company had expected.

The company’s issues underscored how its reputation for innovation, once considered a fundamental element of its brand, has become an albatross, fueling angst among employees and frustration among customers. And company insiders worry that Apple, despite its years of gravity-defying profits, is hamstrung by the political infighting, penny pinching and talent drain that often bedevil large companies, according to more than a dozen former and current employees and advisers.

Apple declined to comment.

It has been a decade since the releases of Apple’s most recent commercial successes: the Apple Watch and AirPods. Its services like Apple TV+ and Fitness+, which it introduced in 2019, lag behind rivals in subscriptions. Half of its sales still come from the iPhone, an 18-year-old product that is incrementally improved nearly every year.

While Vision Pro sales have been disappointing, Apple’s issues with Apple Intelligence exposed dysfunction inside the organization.

In a nearly two-hour video presentation last summer, Apple demonstrated how the A.I. product would summarize notifications and offer writing tools to improve emails and messages. It also revealed an improved Siri virtual assistant that could combine information on a phone, like a message about someone’s travel itinerary, with information on the web, like a flight arrival time.

The A.I. features were unavailable when new iPhones shipped. They arrived in October, about a month late, and quickly ran into trouble. Notification summaries misrepresented news reports, leading Apple to disable that feature. Then, last month, the company postponed the spring release of an improved Siri because internal testing found that it was inaccurate on nearly a third of requests, said three people familiar with the project who spoke on the condition of anonymity.

After the delay, Craig Federighi, Apple’s software chief, told employees that the company would reshuffle its executives, removing responsibility for developing the new Siri from John Giannandrea, the company’s head of A.I., and giving it to Mike Rockwell, the head of its Vision Pro headset.

“Apple needs to understand what happened because this is bigger than just rearranging the deck chairs,” said Michael Gartenberg, a technology analyst who previously worked as a product marketer at Apple. “If ever there’s been an example of over-promising and under-delivering, it’s Apple Intelligence.” It was the first time in years that Apple hadn’t shipped a product it had unveiled.

Some details of Apple’s changes to its Siri team and challenges were previously reported by Bloomberg and The Information.

The A.I. stumble was set in motion in early 2023. Mr. Giannandrea, who was overseeing the effort, sought approval from the company’s chief executive, Tim Cook, to buy more A.I. chips, known as graphics processing units, or GPUs, five people with knowledge of the request said. The chips, which can perform hundreds of computations at the same time, are critical to building the neural networks of A.I. systems, like chatbots, that can answer questions or write software code.

At the time, Apple’s data centers had about 50,000 GPUs that were more than five years old — far fewer than the hundreds of thousands of chips being bought at the time by A.I. leaders like Microsoft, Amazon, Google and Meta, these people said.

Mr. Cook approved a plan to double the team’s chip budget, but Apple’s finance chief, Luca Maestri, reduced the increase to less than half that, the people said. They said Mr. Maestri had encouraged the team to make the chips they had more efficient.

The lack of GPUs meant the team developing A.I. systems had to negotiate for data center computing power from its providers like Google and Amazon, two of the people said. The leading chips made by Nvidia were in such demand that Apple used alternative chips made by Google for some of its A.I. development.

After this article was published, Trudy Muller, an Apple spokeswoman, said the company had fulfilled Mr. Giannandrea’s budget request for GPUs over time rather than all at once. She said Mr. Maestri had never asked the team to make its chips more efficient.

At the same time, leaders at two of Apple’s software teams were battling over who would spearhead the rollout of Siri’s new abilities, three people who worked on the effort said. Robby Walker, who oversaw Siri, and Sebastien Marineau-Mes, a senior executive with the software team, struggled over who would have responsibility for some aspects of the project. Both ended up with pieces of the project.

The infighting followed a broader exodus of talent from Apple. In 2019, Jony Ive, the company’s chief designer, left to start his own design firm and poached more than a dozen integral Apple designers and engineers. And Dan Riccio, the company’s longtime head of product design who worked on the Apple Watch, retired last year.

In their place, Apple has been left with old and new leaders with less product development experience. Mr. Giannandrea, who joined the company in 2019 from Google, had never led the launch of a high-profile product like the improved Siri. And Mr. Federighi, his counterpart overseeing software, had never led the creation of a new operating system like some of his predecessors in that role.

Mr. Cook, 64, who has a background in operations, has been hesitant over the years to provide clear and direct guidance on product development, said three people familiar with the way the company operates.

“It’s clearly a breakdown of leadership and communication and internal processes,” said Benedict Evans, an independent analyst who previously worked as a venture capitalist at Andreessen Horowitz.

Apple hasn’t canceled its revamped Siri. The company plans to release a virtual assistant in the fall capable of doing things like editing and sending a photo to a friend on request, three people with knowledge of its plans said.

Some of Apple’s leaders don’t think the delay is a problem because none of Apple’s rivals, like Google and Meta, have figured out A.I. yet, these people said. They believe there’s time to get it right.

As the clock ticks on fixing Siri, Apple will be defending the assistant’s current shortcomings. Last month, customers filed a federal lawsuit accusing Apple of false advertising. Since then, its commercials about Siri have gone dark.

Brian X. Chen contributed reporting.

How the Crypto Industry’s Political Spending Is Paying Off

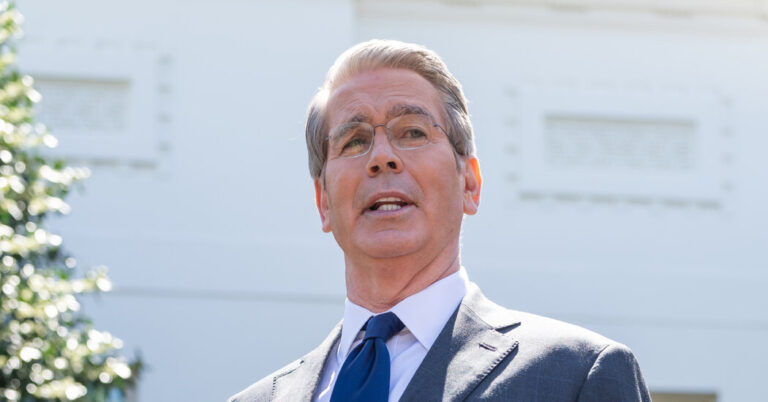

At the end of a three-hour hearing last month, Senator Ruben Gallego, Democrat of Arizona, sided with a group of Republicans in a hotly contested debate. He voted to advance the GENIUS Act, a bill backed by the cryptocurrency industry.

“It’s clear that digital assets are here to stay,” Mr. Gallego said after the Senate Banking Committee hearing. Breaking from the committee’s top Democrat, he called the bill a “step in the right direction.”

The vote, 18 to 6, was only preliminary, advancing a bill that will require approval from the full Senate. But in the crypto world, it was celebrated as a moment of vindication.

Mr. Gallego is part of an increasingly influential cohort in Congress: beneficiaries of the crypto industry’s largess. During a tight Senate race last year, he was aided by $10 million from super PACs financed by three large crypto companies, including the Coinbase digital currency exchange. The money funded ads that promoted Mr. Gallego’s military service and support for border enforcement.

Now he and dozens of other lawmakers supported by the super PACs are taking steps in Congress to advance crypto priorities, handing a series of long-awaited victories to an industry with an extensive history of fraud and volatility.

In the Senate, these legislators have thrown support behind the GENIUS Act, which would pave the way for businesses to issue stablecoins, a digital currency designed to maintain a price of $1. And in both chambers, they have voted to repeal a Biden-era rule that required crypto firms to report certain tax information to the Internal Revenue Service.

An industry spending millions of dollars to influence Congress is hardly unusual. But crypto’s political machine has stood out for the scale of its spending — and the speed of the results.

The industry has responded with glee. The spending is already “bearing fruit,” said Josh Vlasto, a spokesman for Fairshake, a super PAC that worked with two affiliated PACs to support pro-crypto congressional candidates. “This is a total sea change in terms of how Congress is approaching this industry.”

The crypto legislation is progressing just as U.S. regulators roll back a yearslong enforcement campaign. Since President Trump’s inauguration, the Securities and Exchange Commission has dropped lawsuits against major crypto firms like Coinbase and Kraken, lifting a legal cloud over the industry. An investor in crypto himself, Mr. Trump signed an executive order last month calling for the creation of a national crypto reserve — a government stockpile containing Bitcoin and other digital currencies.

The stablecoin legislation is poised to benefit Mr. Trump’s business interests. At a crypto conference in March, he said stablecoins would “expand the dominance of the U.S. dollar” and called for “common-sense” legislation. A few days later, World Liberty Financial, the crypto firm that his family helped start, announced that it would begin selling a stablecoin called USD1.

The stablecoin bill could go to the Senate floor for a vote in the coming weeks — to the alarm of some Democrats who argue that Congress is giving the industry and Mr. Trump exactly what they want.

The crypto industry has “spent a lot of money, and many of our members are beneficiaries,” said Representative Maxine Waters of California, the top Democrat on the House Financial Services Committee. “Many of them may not have taken the time to really examine what it is we’re doing.”

Mr. Gallego was not a sponsor of the GENIUS Act, and has said it requires fine-tuning. (The full name is the Guiding and Establishing National Innovation for U.S. Stablecoins Act.) But he has also defended the bill, saying it includes protections for consumers.

“Senator Gallego believes it is important to have a seat at the table and work with colleagues on both sides,” Jacques Petit, his spokesman, said in a statement. “It remains the senator’s priority to ensure proper guardrails are in place.”

In an interview, Senator Kirsten Gillibrand, a New York Democrat who was a co-sponsor of the GENIUS Act, said crypto spending had no impact on the legislation.

“If you made your decisions on what you’re for based on who’s giving you the most money, you would fail as a member of Congress,” said Ms. Gillibrand, who was not funded by the crypto super PACs.

During the Biden administration, the industry hired expensive lobbyists to push for federal legislation, without making much headway. The 2024 campaign was a turning point.

A group of crypto executives and political strategists formed Fairshake and two affiliated super PACs, Defend American Jobs and Protect Progress, which spent over $130 million to influence tight congressional races across the country. The spending was financed mostly by Coinbase, the digital currency business Ripple and the venture capital firm Andreessen Horowitz, which has financed more than 100 crypto start-ups.

Candidates backed by the super PACs won 53 of 58 races. In Ohio, Defend American Jobs spent $40 million to support Bernie Moreno, a Republican crypto entrepreneur who unseated Senator Sherrod Brown, the Democratic chair of the Banking Committee and an outspoken crypto critic. Protect Progress spent $10 million to help Elissa Slotkin, a Democrat, win a Senate seat in Michigan. And another $10 million from the super PACs boosted Mr. Gallego, who had spoken favorably about crypto in the past.

The industry has since set out to convert those electoral victories into legislation. Executives at firms like Coinbase, Ripple and Binance, a giant exchange that settled criminal charges with the U.S. government in 2023, have descended on Washington, meeting with lawmakers and posing for photographs on the steps of the U.S. Capitol.

Their first priority is the bill laying out rules for stablecoins. The second is “market structure” legislation that would ensure most cryptocurrencies are not subject to enforcement lawsuits by the S.E.C., which conducted a crackdown during the Biden years.

Many lawmakers backed by the crypto super PACs are positioned to advance those objectives. Mr. Moreno, Mr. Gallego and Senator Jim Banks, an Indiana Republican who was supported by the PACs, serve on the Senate Banking Committee. Mr. Gallego is also the highest-ranking Democrat on a new Senate subcommittee devoted to crypto.

A draft of the crypto market structure bill is still in the works. But a group of senators, including Senator Tim Scott, the South Carolina Republican who chairs the Banking Committee, introduced the GENIUS Act in February.

In some ways, companies that issue stablecoins are similar to banks. The coins are supposed to be backed by assets that the issuer holds in reserve: If a firm sells one million stablecoins, it should have $1 million in a vault somewhere so customers can redeem the coins at any time.

But over the years, crypto companies have been scrutinized for failing to maintain sufficient reserves. At the same time, stablecoins have become a useful tool for criminals looking to move money across borders.

In theory, the GENIUS Act addresses those problems by outlining rules for stablecoin issuers. But in February, a coalition of consumer groups called the bill “a crypto industry wish list, not an adequate regulatory regime.” They argued that the bill’s requirements were too loose and would create major risks for customers.

Even some crypto enthusiasts have expressed reservations. A provision in the GENIUS Act would allow overseas companies to get around some of its requirements.

When the bill advanced out of the Senate Banking Committee, four Democrats other than Mr. Gallego, none of whom received support from Fairshake, also voted for it, along with Mr. Moreno, Mr. Banks and 11 Republicans who weren’t backed by the crypto PACs.

A similar bill, the STABLE Act, was introduced in the House last month, prompting Democrats to raise concerns that the new rules could benefit Mr. Trump’s crypto business.

“The president of the United States of America should not be using the power of the office to create business that will enrich himself,” Ms. Waters said in an interview.

But after a marathon hearing on April 3, the House Financial Services Committee voted 32 to 17 to move the bill to the full chamber.

The chair of that committee is Representative French Hill, Republican of Arkansas — a longtime crypto supporter, a co-sponsor of the stablecoin bill and the beneficiary of $100,000 in spending by Fairshake.

Bessent Takes Tricky Center Stage as Trade Wars Roil U.S. Economy

The traditional gathering of former Treasury secretaries to welcome a newly minted one into the fold is usually a lighthearted and pleasant affair. But when the group convened this month, on President Trump’s “Liberation Day,” the tone was strikingly serious.

The dinner, organized by former Treasury Secretary Steven T. Mnuchin, took place at a moment of tumult for the U.S. economy. The president had upended global trade with punishing tariffs on both allies and adversaries, and Treasury Secretary Scott Bessent was at the center of it, defending a policy that many in the room viewed as economic malpractice.

“The mood was somber,” said W. Michael Blumenthal, 99, who led the Treasury Department in the Carter administration and was in attendance.

Mr. Bessent was pressed over the strategy behind the tariffs and the impact that they would have on the economy, according to Mr. Blumenthal and other people familiar with the dinner. At times, Mr. Bessent elevated his voice when his predecessors confronted him about Mr. Trump’s approach.

“He didn’t just smile,” Mr. Blumenthal recalled. “There he is — he has to defend it.”

The guest list included Robert E. Rubin, Henry M. Paulson, Lawrence H. Summers, Timothy F. Geithner and Jack Lew. Former Treasury Secretary Janet L. Yellen was traveling in Australia and did not attend, a spokesman said.

The Treasury Department declined to comment on the dinner, and Mr. Bessent declined to comment for this article.

The bumpy welcome was reflective of Mr. Bessent’s first few months in what might be the most difficult job in Washington. Wall Street hailed his nomination in hopes that he would be a voice of moderation who could temper Mr. Trump’s instincts to lob scattershot tariffs around the world.

Now Mr. Bessent, 62, is at the center of an ugly trade war with China that economists fear could reignite inflation and cause a global recession. By most metrics, the U.S. economy was the strongest in the world when Mr. Trump took office in January, leading some analysts to describe the president’s actions as a historic self-inflicted wound akin to a soccer player’s scoring a goal against his own team.

“It’s one of the largest own-goals in diplomacy and economics and trade that I think we’ve ever done,” said David Autor, an M.I.T. economist.

Before joining the administration, Mr. Bessent had expressed his own doubts about tariffs. But Mr. Trump’s protectionist trade instincts are notoriously hard to corral.

As a former hedge fund manager who founded Key Square Group, Mr. Bessent wrote in a letter to investors just last year that he was skeptical of tariffs: “Tariffs are inflationary and would strengthen the dollar — hardly a good starting point for a U.S. industrial renaissance.”

But as Treasury secretary, Mr. Bessent has had to publicly stick close to the administration’s pro-tariff stance. He now argues that tariffs will not be inflationary but will instead inflict a one-time “price adjustment” on the economy.

Some of his comments have raised eyebrows. After China responded to Mr. Trump’s tariffs by imposing higher levies on American products, Mr. Bessent downplayed the potential impact on the U.S. economy, saying “So what?” In his view, the United States holds the upper hand, because China is reliant on exports to America.

Two days later, Beijing retaliated with even stiffer levies, escalating the economic fight between the world’s largest economies and sending jitters through financial markets.

As markets suffered their worst rout in years, Mr. Bessent suggested that people close to retirement were probably not paying much attention to the falling value of their nest eggs.

“Americans who want to retire right now, Americans who have put away for years in their savings accounts, I think they don’t look at the day-to-day fluctuations of what’s happening,” he said on NBC’s “Meet the Press” last Sunday.

The Democratic National Committee seized on Mr. Bessent’s comment that the economy is in “pretty good shape,” noting that the stock market had been tanking.

Mr. Bessent has been thrust into a somewhat uncomfortable position given that the administration’s trade agenda has been more aggressive than most experts anticipated.

Mr. Trump imposed tariffs on nearly every country, including levies of at least as 145 percent on Chinese imports. The moves sent stocks plunging, strained the bond market and led economists to raise their recession odds.

Some top Republican lawmakers, including Senator Ted Cruz of Texas, have also come out against the tariffs. Mr. Cruz warned on the latest episode of his podcast that tariffs are taxes on consumers.

“It’s terrible for America,” he said. “It would destroy jobs here at home and do real damage to the U.S. economy if we had tariffs everywhere.”

Mr. Bessent has managed to moderate Mr. Trump’s approach, to a degree. During a trip to Mar-a-Lago last Sunday to brief the president on the volatility, Mr. Bessent persuaded him to pause so-called reciprocal tariffs on dozens of countries and begin trade talks with those nations. Upon returning, Mr. Bessent, who had maintained that he was mostly focused on tax policy, said he was taking a leading role in trade talks.

On Friday evening, the administration published a rule that appeared to exempt smartphones, computers, semiconductors and other electronics from most of the president’s punishing tariffs on China, giving tech companies like Apple and Dell a reprieve.

However, the deepening confrontation with China suggested that there will be more volatility as Mr. Bessent engages in debates with Peter Navarro, Mr. Trump’s trade adviser, and Howard Lutnick, the commerce secretary, who have counseled a more hawkish approach.

“The best part is that he can be there as an adviser,” said Marlene Jupiter, who worked with Mr. Bessent for five years when he ran Bessent Capital. She said his deep knowledge of markets should help calm investors who were nervous about the trade uncertainty, but “I don’t know how much Trump listens or does not listen.”

The Treasury secretary’s inability to restrain Mr. Trump more effectively has dismayed some investors.

“In the sense that I’m disappointed in Bessent, it’s that Mnuchin and Cohn never let it get this far,” said Spencer T. Hakimian, the founder of Tolou Capital Management, a New York hedge fund. Mr. Mnuchin, as Treasury secretary, and Gary Cohn, as director of the National Economic Council, were two economic advisers in Mr. Trump’s first term who warned him against the overuse of tariffs.

“The whole reason why markets were interested in Bessent,” Mr. Hakimian added, “is because they saw him as being Mnuchin 2.0 — a traditional Wall Street guy who would not let it get to this.”

Mark Sobel, who served at the Treasury Department for nearly four decades, noted that Mr. Bessent was being credited with scaling back the reciprocal tariffs but raised questions about how he has publicly justified them.

“It will be hard for Americans to see him as a credible and serious economic spokesperson given comments such as that the tariff ups and downs were the strategy all along, or citizens shouldn’t fret about day-to-day stock market fluctuations when their 401(k)s are tanking,” Mr. Sobel said.

Ultimately, however, final decisions over tariffs will lie with Mr. Trump.

“While the Treasury secretary is seniormost economic official in administration, the president is the captain of any team,” said R. Glenn Hubbard, a former deputy assistant secretary at the Treasury Department. “Whatever the Treasury secretary says needs to be on the same page as the president.”

During the dinner with Mr. Bessent, the former secretaries offered encouragement, counsel and historical perspective amid their concerns about Mr. Trump’s policies, people familiar with the matter said.

In one exchange, Mr. Summers, who served in the Clinton administration, told pointed stories about George Shultz, who was nominated to be Treasury secretary by President Richard M. Nixon in 1972 and stood up to his boss over defunding universities and using the Internal Revenue Service to audit political enemies.

In a recent social media post, Mr. Summers said that if he were still in government, he would have resigned over the analysis that the Trump administration produced to support its tariff plan.

Mr. Blumenthal said he wished Mr. Bessent luck in a job that is more complicated when “what is best for country is different than what the president wants.”

He added that traditionally the welcoming meals were light on policy discussion or advice from Treasury veterans.

“This time was a very special occasion,” Mr. Blumenthal said.

Ana Swanson contributed reporting.

Trump Adds Tariff Exemptions for Smartphones, Computers and Other Electronics

After more than a week of ratcheting up tariffs on products imported from China, the Trump administration issued a rule late Friday that spared smartphones, computers, semiconductors and other electronics from some of the fees, in a significant break for tech companies like Apple and Dell and the prices of iPhones and other consumer electronics.

A message posted late Friday by U.S. Customs and Border Protection included a long list of products that would not face the reciprocal tariffs President Trump imposed in recent days on Chinese goods as part of a worsening trade war. The exclusions would also apply to modems, routers, flash drives and other technology goods, which are largely not made in the United States.

The exemptions are not a full reprieve. Other tariffs will still apply to electronics and smartphones. The Trump administration had applied a tariff of 20 percent on Chinese goods earlier this year for what the administration said was the country’s role in the fentanyl trade. And the administration could still end up increasing tariffs for semiconductors, a vital component of smartphones and other electronics.

The moves were the first major exemptions for Chinese goods, which would have wide-ranging implications for the U.S. economy if they persist. Tech giants such as Apple and Nvidia would largely sidestep punitive taxes that could slash their profits. Consumers — some of whom rushed to buy iPhones this past week — would avoid major potential price increases on smartphones, computers and other gadgets. And the exemptions could dampen additional inflation and calm the turmoil that many economists feared might lead to a recession.

The tariff relief was also the latest flip-flop in Mr. Trump’s effort to rewrite global trade in a bid to boost U.S. manufacturing. The factories that churn out iPhones, laptops and other electronics are deeply entrenched in Asia — especially in China — and are unlikely to move without a galvanizing force like the steep taxes that the Trump administration had proposed.

“It’s difficult to know if there’s a realization within the administration that reworking the American economy is a gargantuan effort,” said Matthew Slaughter, the dean of the Tuck School of Business at Dartmouth.

The electronics exemptions apply to all countries, not just China.

Still, any relief for the electronics industry may be short-lived, since the Trump administration is preparing another national security-related trade investigation into semiconductors. That will also apply to some downstream products like electronics, since many semiconductors come into the United States inside other devices, a person familiar with the matter said. These investigations have previously resulted in additional tariffs.

Karoline Leavitt, the White House spokeswoman, said in a statement on Saturday that Mr. Trump was still committed to seeing more of these products and components made domestically. “President Trump has made it clear America cannot rely on China to manufacture critical technologies” and that at his direction, tech companies “are hustling to onshore their manufacturing in the United States as soon as possible,” she said.

A senior administration official, speaking on background because they were not authorized to speak publicly, said that Friday’s exemptions were aimed at maintaining America’s supply of semiconductors, a foundational technology used in smartphones, cars, toasters and dozens of other products. Many cutting-edge semiconductors are manufactured overseas, such as in Taiwan.

Paul Ashworth, the chief North America economist for Capital Economics, said the move “represents a partial de-escalation of President Trump’s trade war with China.”

He said the 20 product types that were exempted on Friday account for nearly a quarter of U.S. imports from China. Other countries in Asia would be even bigger winners, he said. Should the tariffs on those countries kick in again, the exemption would cover 64 percent of U.S. imports from Taiwan, 44 percent of imports from Malaysia and nearly a third of imports from both Vietnam and Thailand, he said.

The changes punctuated a wild week in which Mr. Trump backtracked from many tariffs he introduced on April 2, which he had called “liberation day.” His so-called reciprocal tariffs had introduced taxes that would reach up to 40 percent on products imported from some nations. After the stock and bond markets plunged, Mr. Trump reversed course and said he would pause levies for 90 days.

China was the one exception to Mr. Trump’s relief because Beijing chose to retaliate against U.S. tariffs with levies of its own. Instead of pausing tariffs on Chinese imports, Mr. Trump increased them to 145 percent and showed no willingness to spare any companies from those fees. In return, China on Friday said it was raising its tariffs on American goods to 125 percent.

That sent shares of many technology companies into free fall. Over four days of trading, the valuation of Apple, which makes about 80 percent of its iPhones in China, fell by $773 billion.

For now, Mr. Trump’s moderation is a major relief for a tech industry that has spent months cozying up to the president. Meta, Amazon and several tech leaders donated millions to President Trump’s inauguration, stood behind him as he was sworn into office in January and promised to invest billions of dollars in the United States to support him.

Tim Cook, Apple’s chief executive, has been at the forefront of the industry’s courtship of Mr. Trump. He donated $1 million to Mr. Trump’s inauguration and later visited the White House to pledge that Apple would spend $500 billion in the United States over the next four years.

The strategy repeated Mr. Cook’s tactics during Mr. Trump’s first term. To head off requests that Apple begin manufacturing its products in the United States rather than China, Mr. Cook cultivated a personal relationship with the president that helped Apple win exemptions on tariffs for its iPhones, smartwatches and laptops.

It had been unclear if Mr. Cook could obtain a similar break this time, and the tariffs Mr. Trump proposed were more severe. As the Trump administration increased its taxes on Chinese goods, Wall Street analysts said Apple might have to increase the price of its iPhones from $1,000 to more than $1,600.

The threat of higher iPhone prices caused some Americans to rush to Apple stores to buy new phones. Others raced to buy computers and tablets that were made in China.

Apple did not immediately respond to a request for comment.

Apple’s iPhone quickly became a symbol of the tit-for-tat over tariffs with China. On Sunday, Commerce Secretary Howard Lutnick appeared on CBS’s “Face the Nation” and said the tariffs would result in an “army of millions and millions of people screwing in little, little screws to make iPhones” in the United States. Ms. Leavitt said later in the week that Mr. Trump believed that the United States had the resources to make iPhones for Apple.

“Apple has invested $500 billion here in the United States,” she said. “So if Apple didn’t think the United States could do it, they probably wouldn’t have put up that big chunk of change.”

Apple has faced questions about moving some iPhone manufacturing to the United States for more than a decade. In 2011, President Obama asked Steve Jobs, Apple’s co-founder, what it would take to make the company’s best-selling product in the United States rather than China. In 2016, Mr. Trump also pressured Apple to change its position.

Mr. Cook has remained steadfast in his commitment to China and has said the United States doesn’t have enough skilled manufacturing workers to compete with China.

“In the U.S., you could have a meeting of tooling engineers, and I’m not sure we could fill the room,” he said at a conference in late 2017. “In China, you could fill multiple football fields.”

Additional tariffs on semiconductors and other electronics could come in the next few weeks or months. The administration has signaled it is considering such tariffs under a legal statute known as Section 232, alongside other tariffs on imported pharmaceuticals.

The president has already used the statute to put a 25 percent tariff on imported steel, aluminum and automobiles, and is weighing similar steps for imported lumber and copper. All of those sectors were given exemptions from the so-called reciprocal tariffs that the president announced on April 2.

Speaking to reporters the next day, the president said that other tariffs on chips would be “starting very soon,” adding that the administration was also looking at tariffs on pharmaceuticals. “We’ll be announcing that sometime in the near future,” he said. “It’s under review right now.”

The other tariffs that the Trump administration has applied through Section 232 investigations have been set at 25 percent — much lower than the 145 percent tariff currently in place for many products from China.

Maggie Haberman contributed reporting.

How Tariffs Could Cause Car Insurance Costs to Rise

Add this to worries about the likely impact of tariffs: costlier car insurance.

The new tariffs on imported cars, metals and parts announced by the Trump administration are expected to raise vehicle prices by thousands of dollars if they remain in place. And because parts used in auto repairs will also become more expensive, the average cost of automobile insurance is expected to increase.

The average annual premium for a full-coverage auto policy was just over $2,300 at the end of last year, according to an analysis by Insurify, an insurance comparison shopping website. The site initially estimated that premiums would increase just 5 percent this year, based on factors like inflation and insurer losses.

How much of an impact could tariffs have on car insurance costs?

With the addition of the tariffs, Insurify now projects premiums to rise at least 16 percent, or $378, to almost $2,700 on average nationally — about $256 more than without tariffs. The analysis includes the tariffs on steel and aluminum, those on imported cars and those on imported auto parts scheduled to take effect May 3. (Tariffs announced in February on products from Mexico and Canada were adjusted to exempt some goods, including cars and auto parts, that comply with the free trade agreement President Trump negotiated in his first term, according to Insurify. If that exemption is lifted, the increase in automobile premiums could be as high as 19 percent, the analysis found.)

An Insurify spokeswoman said the Trump administration’s announcement on Wednesday, pausing double-digit global tariffs for 90 days, didn’t change the company’s projections. Treasury Secretary Scott Bessent, in response to a reporter’s question after the announcement, indicated that the pause didn’t apply to certain tariffs like those on automobiles.

“Things that increase the cost of repairs impact prices,” said Robert Passmore, vice president of personal lines with the American Property Casualty Insurance Association, whose members are big insurance companies. About 60 percent of parts used in auto shop repairs are imported from Mexico, Canada and China, the association has said.

The price of car insurance has soared in recent years for a variety of reasons, including more claims resulting from driving habits that deteriorated during the pandemic, the use of more expensive technology in cars, and damage from strong storms and hail. While increases had recently begun to moderate, the cost of motor vehicle insurance still rose 7.5 percent in March compared with a year earlier, according to the Bureau of Labor Statistics.

When will the increases affect driver policies?

Consumers won’t see the impact in their rates immediately, Matt Brannon, a data reporter at Insurify, said. Rather, higher premiums will probably arrive by the end of the year, depending on when your policy renews.

Michael DeLong, the research and advocacy associate for Consumer Federation of America’s campaign for fair auto insurance, said that car insurance is regulated by the states and that insurers must gather several months of claims data, rather than blaming tariffs generally, to show their requests for higher rates are warranted. “They have to justify it,” Mr. DeLong said.

Can I do anything to help keep my auto premium down?

There’s no magic solution to ease the impact of tariffs, said Jon Linkov, deputy autos editor at Consumer Reports. But since the anticipated impact is months away, now is a good time to review your policy to make sure you don’t have coverage beyond what you need or to make other changes that will help tamp down increases from factors beyond tariffs.

“If you usually just rubber-stamp your new premium,” Mr. Linkov said, “reach out to your insurer.” Ask what changes the insurer recommends to save money.

If your car is old and of low value, you may be able to save by dropping optional protections like collision, which covers damage to your car after an accident, or “comprehensive” coverage, which covers theft and damage from things like falling trees, hail or flood. A rule of thumb suggested by the Insurance Information Institute, an industry group, is that you should consider dropping optional coverage if the car is worth less than 10 times the annual insurance premium. (Liability coverage, which pays for injuries to others or damage to property you cause when driving, is required in nearly all states, although minimum coverage amounts vary.)

You could also consider raising your deductible, an amount you must pay out of pocket when filing a claim. If you have a $500 deductible, you could lower your premium by as much as 25 percent by raising the deductible to $1,000, Mr. Linkov said. But make sure you can cover that amount, if you do need to file a claim.

“Do you have the cash available?” he said. “Make sure you put the savings aside, so you’ll have it if you need it.”

If you have young adults on your policy, check to see if it would be less expensive to have them get their own coverage. “It may be time to kick them off,” Mr. Linkov said.

It can pay to shop around, experts said. You can use various online marketplaces, but use a backup email for receiving quotes to avoid being inundated with inquiries from insurers. Have your current auto policy in front of you when you shop to be sure you are getting apples-to-apples quotes for the same coverage, Mr. Passmore said. (And before getting your hopes up, read about my colleagues’ failed experience in shopping for cheaper rates.)

Should I try a system that monitors my driving?

You can save money by allowing an insurer to install a device in your car that monitors your driving behavior or tracks your driving on your phone, Mr. Passmore said. Discounts of 10 percent are common just for signing up. The systems typically gather information such as how far you drive, what time of day you drive, braking and acceleration, and phone use.

Mr. Passmore said he used one himself and found that it had made him a better driver: “I was surprised how much hard braking I was doing.”

But both Consumer Reports and the Consumer Federation have concerns about such systems because they lack privacy protections. There’s little regulation, as of yet, about what exactly insurers can do with the data they collect, Mr. Linkov said.

If, however, you are driving less — perhaps because you have moved and have a shorter commute or are working at home — by all means contact your insurer with the new mileage total and ask for your policy to be re-rated, Mr. Linkov said. Fewer miles driven means a lower risk of accidents, which should translate to lower rates.

Becoming a safer driver can also help you avoid accidents and speeding tickets. So taking a “defensive driving” course may save you money. “Driver history is still the most important part of how your rate is set,” Mr. Brannon said.

Insurers may offer discounts for having premiums taken directly from your bank account or for student drivers who maintain good grades. So ask about those, too.

Can I save money in repairs?

If you always get service from the dealership where you bought your car, it may be worth checking around to see if an independent repair shop could save you money, Mr. Linkov said. Ask around for references and start out with a basic service like an oil change or tire rotation. If the shop doesn’t turn routine maintenance into a hard sell for more expensive work, consider taking your business there.

Should you ever have to file an insurance claim, he said, a knowledgeable mechanic can advise you on issues like whether it’s acceptable to use cheaper “aftermarket” parts for certain repairs or if you should push your insurer to cover parts from the original manufacturer, which is often preferable.

Hostages Still Held in Gaza Cast Shadow Over Passover in Israel

When Yona Schnitzer, a marketing writer from Tel Aviv, attended the traditional Passover Seder meal last year, he said a special prayer for the return of all of the hostages still being held by Palestinian militants in Gaza.

He had thought their freedom would be secured by Passover 2025, but that did not happen.

“It’s become so normalized that there are hostages in Gaza,” said Mr. Schnitzer, 36. “It’s surreal and heartbreaking.”

On Saturday evening, Israelis observed the beginning of Passover, the weeklong Jewish festival of freedom, for the second time since the Hamas-led Oct. 7, 2023, attack that ignited the war in Gaza. The holiday is usually a celebration of the biblical story of the ancient Israelites being liberated from slavery in Egypt, with families gathering to retell that story, sing songs and eat special foods.

But for many Israelis, the continuing captivity of the hostages has made it difficult to feel the joy of the holiday.

“We will mark the holiday. We won’t celebrate it,” said Orly Gavishi-Sotto, 47, a college administrator from northern Israel. “We can only celebrate when all the hostages are home.”

Ms. Gavishi-Sotto said her family would put an empty chair at the Seder table, symbolizing the hostages in Gaza who could not be with their families.

The Israeli government has said that it believes that 24 of the 59 remaining hostages are still alive.

On Saturday evening, as Israelis gathered with their families to mark Passover, Hamas released a new video showing one of those hostages, Idan Alexander. In a statement distributed by a hostage advocacy group, Mr. Alexander’s family asked the news media not to circulate the footage.

In January, Israeli and Hamas negotiators agreed to a cease-fire that was supposed to lead to the freedom for the rest of the hostages. Thirty living hostages and the bodies of eight others were returned during the initial six weeks of the agreement, but Israel resumed attacks on Gaza on March 18 after the two sides failed to agree on an extension of the truce.

Some 1,200 people were killed in Israel in the October 2023 attack, according to the government. More than 50,000 people in Gaza have been killed since the start of the war, according to the territory’s health ministry, which does not differentiate between civilians and combatants in casualty counts. Since the cease-fire fell apart, more than 1,500 people in Gaza have been killed, the ministry says.

Dani Miran, 80, whose son Omri Miran is a hostage in Gaza, said he was planning a simple Seder with his family and trying to reassure his granddaughters that their father would come home.

Omri Miran, now 48, was taken by Palestinian militants on Oct. 7, 2023, from Kibbutz Nahal Oz near the Israeli border with Gaza. He; his wife, Lishay Miran-Lavi; and their two daughters, Roni and Alma, were initially held at gunpoint, according to family members, but only he was forced to Gaza.

“Omri has been in the tunnels for over a year and a half,” Mr. Miran said. “I don’t know what his mental state is. I can only hope he’s strong enough to endure this tragedy.”

The Hostages Families Forum, a group that represents the relatives of many captives, called on Israelis to hold Seders in an outdoor plaza in Tel Aviv that has come to be known as “Hostages Square.” The group described Passover this year as “another Festival of Freedom without true freedom.”

Odie Arbel, 77, a resident of Kibbutz Yiftah in northern Israel, said his family would be using a hostage-themed Haggadah, the text read during the Seder, which tells the story of the Israelites’ liberation.

“A key principle of Judaism and Israeli identity is the redeeming of captives,” he said.

More than 68 percent of Israelis say they believe freeing hostages is more important than removing Hamas from power, according to a survey published by The Israel Democracy Institute on Thursday.

Prime Minister Benjamin Netanyahu of Israel has said the war will not end until Hamas’s military wing and Gaza government are dismantled. Hamas has said it will not free all of the hostages unless Israel ends the war permanently.

Mr. Arbel, who is critical of the government, said while he was reflecting on the plight of the hostages this Passover, he was also thinking about the suffering of Palestinian civilians in Gaza and the West Bank.

“I’m thinking about the difficulties of both peoples,” he said.

The 2025 Masters In Photographs

The Masters Tournament is a symbolic start of spring in North America, and the hundreds of acres of magnificent flora at Augusta National Golf Club — azaleas, pink dogwood, yellow jasmine, magnolia and oak trees, and hundreds more varieties of flowers, shrubs and trees for which the course’s 18 holes are famously named — are a breathtaking backdrop for the first major tournament of the men’s golf season.

Justin Rose began Saturday’s third round at eight under par, followed closely by the two-time U.S. Open winner Bryson DeChambeau at seven under and the 2022 Masters runner-up Rory McIlroy tied with Corey Connors at six under. Scottie Scheffler, the 2022 and 2024 Masters champion, was in a four-way tie for fifth at five under par.

Rose, a 44-year-old Englishman, has led or shared the lead after a round at the Masters 10 times, including on both Thursday and Friday, but has never won a green jacket. He finished as a runner-up in 2015 and again in 2017, when he lost in a playoff to Sergio Garcia.

Inside Mohamed Salah’s contract saga: Lawyer’s concerns, Saudi interest – and a deal that pleases everyone

In the end, the news that Mohamed Salah will remain at Liverpool was delivered with a humorous tagline.

“More in than out,” read the message across the club’s social media pages at 8am on Friday, around 36 hours after reports in the forward’s homeland of Egypt first suggested he had agreed to extend his eight-year stay at Anfield.

It was a play on words, nodding to Salah’s comments in November when his future on Merseyside felt far more tenuous. The fact that he felt “more out than in” after scoring two crucial goals in a 3-2 come-from-behind win at Southampton that day was confirmation that the process of his contract negotiations has not exactly been smooth. Though Liverpool always felt confident a successful resolution would be reached, that scenario was not inevitable.

He’s staying. pic.twitter.com/AnhqQjUg7g

— Liverpool FC (@LFC) April 11, 2025

Now, however, the deal is done.

Salah has signed a two-year extension, with no breaks or release clauses, on terms very similar to the ones that almost certainly made him the second-highest-paid player in the Premier League behind Manchester City striker Erling Haaland. While his previous contract included a basic weekly salary of £350,000 ($480,000), when bonuses and performance-related incentives were taken into account, Salah’s package was worth far more. Including external commercial endorsements, some of which also had performance-related clauses, he earned up to £1million per week.

This new contract’s lucrative nature reflects Salah’s status and his ongoing excellence, even though he’ll turn 33 in June. After scoring 243 goals in 394 games, he is set to complete a decade’s service at Anfield.

Discussions on this latest deal have been a drawn-out process, rather than there being any breakthrough ‘moment’, and have taken nearly a year. The path has not been straightforward.

The Athletic has talked to figures with intimate knowledge of those negotiations, who spoke to us on condition of anonymity to protect relationships, to understand why they took so long, how both parties approached them and what ultimately clinched an agreement.

Ramy Abbas, the Colombian lawyer who is Salah’s long-time representative, does not like discussing sensitive matters on his phone. For him, it is convenient that services such as WhatsApp are banned from receiving or making calls in the United Arab Emirates, where he lives.

Though messages are permitted, hundreds of them are usually left unread on his accounts, many from potential commercial partners looking to work with his most famous client. A note on his WhatsApp profile warns: “Voice notes ignored. If you’re late, I will leave.”

Abbas is transactional, he likes efficiency and he prefers to meet in person.

When Liverpool signed Salah in the summer of 2017, their sporting director at the time, Michael Edwards, and chief scout Dave Fallows flew to Dubai out of respect for Abbas. They wanted to show him how keen they were to sign Salah from Roma.

Having arrived in the evening when it was already dark, they headed home to England a few hours later without ever taking their jumpers off. On that return journey, the pair joked they must be the only visitors to leave the Gulf resort without experiencing any sun on their backs.

— Ramy Abbas Issa (@RamyCol) July 1, 2022

That negotiation was relatively straightforward due to Salah’s enthusiasm for a return to the Premier League, where he felt he had much to prove having barely played during a previous spell with Chelsea.

When Liverpool’s new sporting director, Richard Hughes, picked up the phone to introduce himself to Abbas in July last year, however, there was much work to do.

Hughes had inherited significant challenges at Liverpool, starting with the recruitment of a manager/head coach to succeed Jurgen Klopp, who stepped down at the end of last season after almost nine years. Following the hiring of Feyenoord coach Arne Slot to fill that vacancy, Hughes moved on to player retention: as with Salah, there was only 11 months left on the contracts of the team’s captain, Virgil van Dijk, and his deputy, Trent Alexander-Arnold, the Liverpudlian local hero.

Alexander-Arnold’s case was different to the others in that he was in his mid-twenties, and had active interest from Real Madrid. Salah and Van Dijk were in their early thirties, and while still performing at an elite level, Liverpool were conscious that their previous contracts had been agreed when both were at the peak of their powers.

The mantra from Liverpool and the club’s owners at Fenway Sports Group (FSG) was the need to ignore the question of, ‘What looks like the right decision today?’, and rather frame it as, ‘What will look like the right decision in future?’.

Virgil van Dijk was also holding contract talks (Ryan Pierse/Getty Images)

That first conversation between Hughes and Abbas was brief and casual, with the sporting director promising that he would be in touch again soon to discuss Salah’s future. Like Edwards and Fallows had years earlier, Hughes would subsequently travel to Dubai to see Abbas, going twice before the end of 2024.

The first meeting, in late September, was held in the bar of one of the city’s quieter restaurants but the discussion was again short and informal until Hughes asked Abbas whether Salah wanted to stay at Liverpool. Abbas told him that he did, but the sporting director flew back to the UK with Abbas concerned the club might not be willing to maintain his client’s level of remuneration.

Abbas was impressed by Hughes but was left asking himself whether Liverpool valued Salah quite as much as they used to. He wondered whether the lack of commitment represented a hostile act.

As far as Salah was concerned, he was operating at the same level as the best players on the planet and showing no signs of slowing up, despite a disappointing end to last season after sustaining a hamstring injury at the Africa Cup of Nations in January 2024. The goals and assists were flowing.

Salah and Abbas understood the player’s salary would be in line with what he might achieve in the future but they wanted to sustain his position as one of world football’s best-paid players.

Liverpool, for their part, maintain that a pay cut was never on the agenda and that they always wanted to keep Salah. They had no issue with Salah pushing for the best possible terms and FSG had, after all, sanctioned lucrative deals for players — including Salah — worth the investment. They were also conscious of the need to try to find common ground with Abbas before tabling a formal offer.

There was also an acknowledgement, however, that any deal could not run counter to FSG’s sustainable financial model and had to be in the best interests of the club. For Liverpool’s owners, this principle could not be sacrificed, regardless of how valuable Salah was to the team’s chances of on-pitch success.

Richard Hughes, Liverpool’s sporting director (John Powell/Liverpool FC via Getty Images)

Salah thought the best years of his career were still to come.

Until Manchester City’s Rodri won it at age 28 last year, Ballon d’Or winners over the previous decade had all been in their early to mid-thirties and he wasn’t turning 33 until June 2025. Salah believed that his goals fuelling a successful Liverpool side would allow him to follow legends such as Lionel Messi, Cristiano Ronaldo, Luka Modric and Karim Benzema in winning that award, recognising the best footballer of the previous 12 months.

Hughes had travelled to that first meeting alone but Abbas wondered about Edwards’ involvement behind the scenes. Though he now officially worked for FSG, rather than the club, it was ultimately his responsibility to manage the budgets in the organisation’s football interests. Liverpool were not in financial distress. Though the club was expected to post a loss before tax for the 2023-24 season, it remained well within the limits for profit and sustainability rules (PSR) for the following campaign.

When Salah last renewed with Liverpool in July 2022, a deal that made him the highest-paid player in the club’s history, the contract was brokered and signed off by FSG president Mike Gordon. Julian Ward had succeeded Edwards as Liverpool’s sporting director but the meatier conversations were between Gordon and Abbas. That negotiation was a slog and Abbas and Salah both felt that the player’s future lay elsewhere just three weeks before an agreement was reached.

Abbas was unsure whether a resolution would have been found had Edwards led that process. He had brokered a complex package that was realistically achievable but, on a basic level, more lucrative than the figure suggested publicly. He was proud of the deal, realising that the club and their owners had extended themselves as far as they could to keep Salah, and even allowed the prestigious Harvard Business School in the United States to turn it into a case study.

Mohamed Salah signs his previous contract in 2022, along with Ramy Abbas (facing away from camera), and club officials Jonathan Bamber and Julian Ward (Nick Taylor/Liverpool FC via Getty Images)

The revelation that FSG had authorised a record-breaking deal to keep Liverpool’s star man meant it was more difficult for any of its critics to accuse it of being tight with money but it also suited the owners to keep the figures lower. If it was known that Salah was earning considerably more than some of his team-mates, there was a danger that Liverpool’s pay structure would spiral out of control.

FSG brought Edwards back into the organisation in March last year to try to re-establish a chain of command that existed at Liverpool before it became a manager-led operation under Klopp. The owners knew how ruthless Edwards could be. Yet beyond him and Hughes, Abbas could not shake the feeling that Gordon would also still be involved when it came to the final figures, if the negotiations ever got to that stage. FSG’s money was ultimately Gordon’s, and he would be the one signing off any deal.

In a second Dubai meeting between Abbas and Hughes in October, the conversation didn’t move on very far, with the lawyer concluding the discussion was light on meaningful content. It was his view that negotiations had not even really started. Abbas’ policy had always been to let the club make the first move, allowing him to see clearly how highly they valued his client. The lack of pace or urgency worried him.

Towards the end of November, Abbas did not know how much Liverpool were willing to pay Salah or how long they wanted him to stay. Though he was told there was an offer in the making, nothing happened. He was confident Liverpool would deliver on their promise eventually, but was increasingly beginning to think it would only be done to save face, allowing the club to claim they had tried to keep Salah — even though they knew the offer made to him would be rejected.

This explains why, on November 24, after he’d scored twice in the second half to inspire that win at Southampton, the player decided to speak to journalists about his future, telling them he was disappointed not to have received a new contract offer, before making his “more out than in” comments regarding the 2025-26 season.

Nothing that Salah says publicly is done without consideration. He is rarely impulsive and little is improvised. Initially, he planned to tell UK broadcaster Sky Sports about his frustrations but in the immediate post-match interview, he was not asked about his future. Outside the stadium, as he boarded the team bus, he asked print journalists whether they were willing to ask the difficult questions.

It was unusual to hear a player as private as Salah speak so openly. Yet on this occasion, he felt as though he was able to attack the situation because Abbas only represents him. Neither the player nor the lawyer had team-mates or other clients to think of at Liverpool.

Salah would subsequently receive criticism, notably from Sky Sports pundit Jamie Carragher, a former Liverpool defender, for speaking out. A comparison was drawn with Van Dijk, but Abbas had been told that the Dutchman had already received a contract offer while his client had not. Therefore, Salah had more of a reason to go public about his concerns.

Hughes had taken the view early on in the process that he had no desire to put anything relating to the contract talks in the public domain, reasoning that doing so would only cause issues for Salah (who he wanted to focus simply on scoring goals and winning games), new coach Slot or the team as a whole.

This often meant the club being subjected to ferocious criticism, particularly on social media, for seemingly allowing talks to drift and uncertainty to foment. A fan’s banner also appeared on the Kop during a match at Anfield, nodding to Salah’s ‘bow and arrow’ goal celebration, urging FSG: “He fires a bow, now give Mo his dough!”

Yet, for Hughes, it was deemed a price worth paying, even after the Southampton game when the temptation to become drawn into a public debate may have been acute. Following that banner’s advice would have been the antithesis of FSG’s principles.

A banner on the Kop encouraging FSG to finalise Salah’s new contract (Visionhaus/Getty Images)

Abbas was open-minded about the length of any new contract, despite some claims the issue was causing a dispute. If the offer was right, Salah was willing to extend his stay at Liverpool by only one year. Yet as November turned into December, both parties were not even at the numbers stage.

It was certainly in Liverpool’s interest to ensure Salah’s deal was the last one signed among the three players approaching free agency. If he were the first and his salary remained high, the representative of every other player at the club would have a figure to work from during their own contract negotiations. It was Abbas’ view that Salah was the star player and, just as Andriy Shevchenko (a striker) had earned more money than Paolo Maldini (a defender) at Milan decades earlier, so Salah deserved the more lucrative package.

With the focus swinging from Liverpool’s table-topping surge in the Premier League to Salah’s future after his words with reporters in Southampton, champions Manchester City were the team’s next opponents at Anfield the following Sunday — December 1. Earlier in the week, Abbas had flown into London’s Heathrow Airport, taking a meeting with a sponsor in Manchester before a night back in London, where he ate at one of his favourite Japanese restaurants. He travelled north again by train, arriving in Liverpool a few hours before kick-off and heading into a hospitality suite at the stadium without anyone from the media noticing him.

Though Hughes had contacted him about Salah’s comments the previous weekend, there was no summit with the sporting director. After watching the match, which Liverpool won 2-0, with Salah scoring the late clincher, Abbas flew back the next morning to Dubai via Manchester, no closer to knowing where his client’s future lay.

Abbas had earmarked the start of February as a cut-off point for any decision. That would leave a reasonable amount of time to try to find a resolution with Liverpool, or failing that, reach an agreement somewhere else.

Foreign clubs could not officially talk to Salah until January. Abbas was planning to spend the first month of 2025 broadening his client’s options but he knew that Salah’s priority was to re-sign with Liverpool. He was enjoying playing under Slot, and admired the head coach’s sense of superiority — he did not seem to mind embracing the expectations that fall upon the club.

Previously, Klopp liked to cast himself as the underdog but Slot was the opposite: Liverpool were a global superpower who should be winning trophies. Salah respected that attitude. Whereas Klopp had regularly complained about the demanding fixture schedule, Slot seemed to relish it. There were no excuses — it was all on the manager, the staff and the players to find solutions.

By Christmas, Liverpool were leading the Premier League by four points and also top of the reformatted Champions League table. Salah was convinced this was his and the club’s season of opportunity. Abbas, by comparison, believed success did not always lead to good sporting or business decisions. Win the league and it would be a much easier argument for Liverpool to then let Salah go, as the fan pressure might not be as significant.

This potentially left a curious dynamic: could it be true that the better Salah and Liverpool did, the weaker his chances of staying at Anfield beyond the summer of 2025 became? Salah wanted to play at the highest level for as long as possible. If Liverpool ended up winning the Premier League and Champions League, then anywhere else at that point was down as far as he was concerned.

At the turn of the year, this made the Saudi Pro League a low-probability destination. Though it was a league with mind-boggling resources, Saudi Arabia was also a developing country in football terms. Salah also loved living in England, where his family privacy was respected — he has a wife and two daughters who are well settled in the county of Cheshire, just south of Liverpool — and he could focus on his career. Would that be the same if he returned to the Middle East?

In the long-term, Abbas was interested in the United States but Major League Soccer did not make any approaches. While there was press speculation that Paris Saint-Germain were another option, in early January, the French club’s president Nasser Al-Khelaifi denied he was targeting the player.

By mid-January, the player’s sponsors were getting twitchy, keen to know where Salah’s future lay. Abbas did the maths about what a move to France would mean — Salah’s endorsements would take a serious hit because Ligue 1 does not have the same global visibility as the Premier League. This contributed to Abbas being more inclined towards a longer stay in England, preferably with Liverpool. Salah would not trash his legacy by joining a rival, which ruled out both Manchester City and neighbours United.

There was some intrigue about Chelsea, where he’d played for just over a year across 2014 and early 2015 and was considered a failure as he was first loaned to Fiorentina and fellow Italians Roma, then sold to the latter in August 2016. Salah felt as though he still had something to prove at Stamford Bridge, yet any deal to go back was reliant on Chelsea abandoning a transfer strategy that focuses on signing young players. Any move to another English club was also made more complicated by the fact none of them were legally allowed to negotiate with Salah until May.

Salah feels he has unfinished business with Chelsea (Richard Heathcote/Getty Images)

By the end of January, Salah had told his family that there was a chance they would have to uproot from their Cheshire home. For Abbas, there were now two clear options: stay at Liverpool, or, somewhat reluctantly, agree a deal with the only alternative that could satisfy his financial expectations.

That meant one of the Saudi Arabian clubs, most likely reigning champions Al Hilal in the capital, Riyadh, who had wanted him for their Club World Cup campaign this summer. Though Abbas had held talks with other clubs owned by the state Public Investment Fund (PIF), he was increasingly beginning to think that the interest in his client was a charm offensive by the country’s football powers to show how highly Salah was valued.

Abbas did not have an offer in writing but the numbers the Saudis were talking about would remove any concerns about sponsors and how they would react. His contacts in Saudi Arabia told him that if Salah wanted to move there, then an offer would come, though Abbas was mindful of what might happen if it became clear first that a new deal was not happening at Liverpool. Potentially, this would leave Salah exposed and suddenly he would be in a buyers’ market.

Of more significance, however, was what was happening closer to home.

By early December, Liverpool had finally made Salah an offer. Abbas’ fears were allayed and he considered it something to work from. He was happier now with the way things were going because of the regularity of the contact with the club.

Liverpool seemed more serious but Haaland’s nine-year contract at City, announced in the middle of January, had the potential to complicate things. What was he earning? Abbas understood that any deal for Salah would be much shorter but if Haaland was setting the rate for forwards, given Salah was outscoring him and playing for a team higher up the table, his wage ought to be competitive with what City were paying the Norwegian.

By now, speculation was reaching fever pitch, something Abbas found faintly amusing.

When it was suggested by local media on Merseyside at the end of January that he was flying in for talks, Abbas posted a picture on Instagram of the view from his home in Dubai.

Halfway across the world, Salah continued to hit landmarks: after scoring his 50th European goal for Liverpool on January 21 in a Champions League game against Lille, Slot spoke about his “elite mindset”. Back in Dubai, Abbas had dinner with his wife before watching that game at their apartment. Despite making progress, he and Liverpool remained some distance away from an agreement.

After January, however, Salah did his best to divert questions about his future.

In an interview with Sky, he insisted he did not know which club he was going to be playing for after this season, suggesting that if these were his final months at Liverpool, he did not want his memories of the period attached to any wrangling related to an impending exit. Instead, the focus would be on his and the club’s attempts to bring more trophies to Anfield.

The change of tactics was also a reflection of momentum shifting, with progress being made between Hughes and Abbas. On Valentine’s Day, Abbas was in a somewhat combative mood, posting on Instagram about too many social media users craving “attention and validation” from people they’ve never met, before switching to X, where he was rather more complimentary about Liverpool’s head coach, who he said was “excellent at his job” after taking the team seven points clear at the top of the Premier League.

Slot, meanwhile, was making it clear in interviews that he wanted Salah to stay, and the determination of the player to continue with Liverpool reflected the respect the Dutchman had gained during his debut season.

Arne Slot has struck up a good relationship with Salah (Alex Livesey/Getty Images)

Outside the club, many were baffled why all this was taking so long. Internally, Liverpool were relaxed about leaving any decision about Salah as late as possible.

They knew the retention of Salah would allow Liverpool to continue as the “destination club” they had become under Klopp, but they considered it smart practice to wait, as the team had settled into a rhythm, and this time gave Hughes and other club officials more of an opportunity to be sure the player was capable of maintaining his performances at age 33 and beyond.

The deal, when it was announced just before 8am on Friday UK time, involved images of Salah sitting on a throne beneath the Anfield floodlights at night. They had been taken the previous evening, when it was easier to get him in and out of the stadium without being seen.